This summary reflects the House bill. The Senate bill, which passed early Saturday morning, has differences and will go to conference to reconcile the difference in the two bills.

Changes to Individual Income Tax:

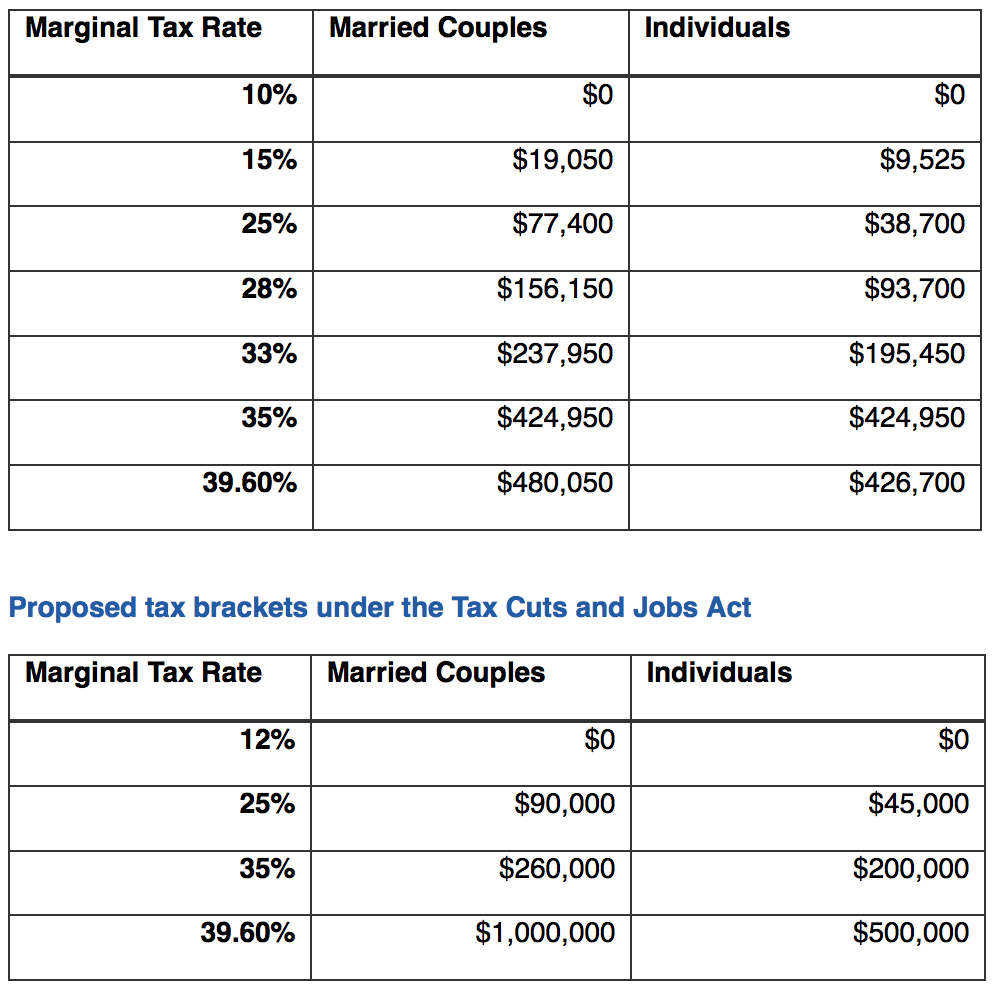

Consolidates the current seven tax brackets into four with rates of 12%, 25%, 30%, and 39.6%.

2018 Tax brackets under the current law:

Changes to the Standard Deduction for Families:

Sources: I.R.S.; House Ways and Means Committee | Proposed deduction amounts are comparable to the current 2017 levels and would increase with inflation in 2018.

At New Door Residential NewDoorResidential.com we stay informed about all things regarding local Las Vegas real estate.

Call Jeff Galindo Owner | Broker | Realtor Today at 702-659-9005

Individual Highlights:

-

Eliminates the personal exemption. Creates a $300 personal credit, along with a $300 non-child dependent personal credit, in place for five years.

-

Increases the child tax credit to $1,600, with $1,000 of the tax credit initially refundable. The refundable portion is indexed to inflation until the full $1,600 is refundable. The phase-out threshold for the child tax credit is also increased: for married households, it rises from $110,000 to $230,000.

-

Retains the mortgage interest deduction, but with a cap of $500,000 of principal on newly-purchased homes. Also retains charitable contribution deductions and the deduction for state and local property taxes, the latter of which would be capped at $10,000; eliminates the remainder of the state and local tax deduction along with other itemized deductions.

-

Eliminates the individual alternative minimum tax.

-

Indexes tax brackets and other components using the chained CPI measure of inflation.

-

Eliminates the ability to re-characterize Traditional or Roth IRA contributions during a tax year.

Changes to Business Taxes:

-

Reduces the corporate income tax rate from 35 percent to 20 percent.

-

Eliminates the corporate alternative minimum tax.

-

Taxes pass-through business income (LLC, LP’s, Subchapter S corps) at a maximum rate of 25 percent, subject to anti-abuse rules.

-

Allows for capital investment, except for structures, to be fully and immediately deductible for five years, and increases the Section 179 expensing limit from $500,000 to $5 million, with an increased phase-out threshold.

-

Limits the deductibility of net interest expense on future loans to 30 percent of earnings before interest, taxes, depreciation, and amortization for all businesses with gross receipts of $25 million or more.

-

Restricts the deduction of net operating losses to 90 percent of net taxable income and allows net operating losses to be carried forward indefinitely, increased by a factor reflecting inflation and the real return to capital. Eliminates net operating loss carrybacks.

-

Eliminates the domestic production activities deduction (section 199), and other business deductions and credits.

-

Creates a territorial tax system, exempting from U.S. tax 100 percent of dividends from foreign subsidiaries.

-

Enacts a deemed repatriation of currently deferred foreign profits, at a rate of 12 percent for cash and cash-equivalent profits and 5 percent of all other profits.

-

Multi-National Corporations such as Apple will face a 10% Global Minimum Tax that high-profit subsidiaries of American Companies earn anywhere in the world (more than 2.5 trillion in American Profits held offshore).

Other Changes:

-

Double the estate tax exemption to roughly $11,000,000 meaning families can avoid paying estate taxes on all but the largest estates (over $22,000,000). Eliminates the federal estate tax eventually, phasing it out entirely in six years.

-

Expands the qualified expenses associated with 529 Savings Plans including up to $10,000 per year for elementary and high school expenses and also adds expenses for apprenticeship programs

-

Will now be able to open a 529 Plan for a child in utero and will not have to wait for the child to be born.

-

The plan would end all contributions to Coverdale ESA’s after 2017 but allow tax free rollovers to 529 Plans

-

3.8% Net Investment Tax which is part of Obamacare would be repealed under the bill.

Potential Landmines:

-

Limits on Mortgage Interest Deductions

-

Limits on State and Local Tax Deductions

-

Individuals who earn more than $1,000,000 would incur a 6% surtax on the next $200,000 of taxable income resulting in a 45.6% bubble bracket. (438,000 taxpayers had income in excess of $1,000,000 – could result in $50 billion of revenue over ten years)

-

Eliminates the 15% credit for individuals over age 65 who are disabled or retired

-

Eliminate the Adoption Tax Credit

-

Eliminate the deduction for tax preparation and repeals the credit for alimony payments

-

Potential limit in Senate bill on deducting 401k plan contributions above $2,400 per year.

-

Elimination of the deduction for Medical Expenses.

Want to see the best real estate deals in town, Click Here

Call Jeff Galindo Owner | Broker | Realtor Today at 702-659-9005